Our Early Learning and Outside School Hours Care programs qualify for the Federal Government's Child Care Subsidy (CCS). This may reduce your child care fees if your family is eligible for CCS support.

What is the Child Care Subsidy?

Child Care Subsidy (CCS) helps eligible families access approved and registered child care providers by partially subsidising the cost of daily fees.

From 10 July 2023, there will be changes to how Child Care Subsidy is calculated, meaning more families will be able to claim CCS. Find out more on the Services Australia website.

How does the Child Care Subsidy work?

The Federal Government provides CCS directly to providers (like the Y) who then pass the subsidy to families as a fee reduction. Families will pay us the difference between the subsidy and the full fee.

Who is eligible for Child Care Subsidy?

To be eligible for CCS, you must meet the key requirements below.

Your child must:

- be 13 years of age or under and not attending secondary school;

- meet immunisation requirements;

You or your partner must:

- care for your child at least two nights per fortnight or have 14% share of care;

- be responsible for child care fees;

- meet residency requirements;

- enrol with an approved child care provider.

How much is the Child Care Subsidy?

The amount of subsidy families receive is calculated by a number of factors.

This includes:

- the hours of work-related activity you do (activity level);

- your combined family income;

- the type of service you use.

We've explained these factors in more detail below.

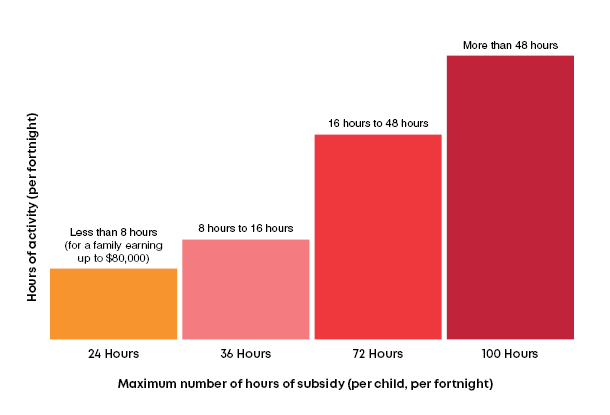

Activity level

Activity level is the term the government uses to describe the amount of work you do per fortnight. This includes paid work, but also activities like study and volunteering.

The government uses your activity level to assess the number of hours of subsidy you can claim. Essentially, the more hours of work you do, the higher the subsidy you could be entitled to.

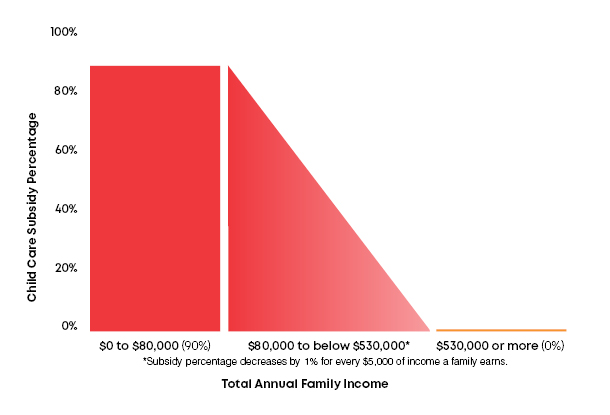

Combined family income

Your estimated combined family income also determines the amount of subsidy you can claim. The income estimate is made up of your (or you and your partner's) taxable income for the current financial year.

You must provide this information to Services Australia when you apply for CCS and keep it updated if your income changes.

5% withholding on payments

Because some families are unable to estimate their income accurately ahead of time, Centrelink withhold 5% of the CCS each fortnight to reduce the likelihood of you getting an overpayment.

If you overestimated your family income and didn't receive enough CCS, the outstanding amount will be paid directly to you at the end of the financial year. This includes the 5% payment withheld over the year.

If you underestimated your annual family income you may have a debt which you’ll need to pay back. The 5% amount withheld will be used to reduce the debt.

Service type and hourly rates

The type of service you use, the hourly fee that your child care service charges, and the age of your child also determine the amount of CCS you can receive.

Visit the Department of Human Services website for further information.

Can I get additional support with the cost of child care?

Some families who are eligible for CCS can also claim Additional Child Care Subsidy (ACCS), which provides additional support with child care costs..

To be eligible for ACCS, you must qualify for Child Care Subsidy and meet one of the following criteria:

- you're an eligible grandparent getting an income support payment;

- you're transitioning from certain income support payments to work;

- you're experiencing temporary financial hardship;

- you're caring for a child who is vulnerable or at risk of abuse, harm or neglect.

Visit the Services Australia for further details on ACCS.

How to apply for Child Care Subsidy

You can apply for Child Care Subsidy using your MyGov account. You will need to link this to Centrelink. Follow the steps to make a claim and make sure to submit all your supporting documents. Find out more on the Services Australia website.

If you have any questions, please email us and we'll be happy to help.